Publish date:

My most popular post on i3 is currently,

“The valuation of financial institutions. And why Coldeye is wrong on MBSB”

In it, I stated that, in general, most companies fall into 3 categories when it comes to valuations. They are

1. Any company other than those in the other 2 category.

2. Banks and Non Deposit Taking Financial Institutions.

3. Insurance companies.

And created a rough guide on how to value financial institutions and what to look.

It was only recently I found the time to properly study how to value insurance companies, and do my own research on Malaysian Insurance Companies.

I originally planned to release this at the end of December, the same time as my previous financial institution article. But I figured, what the heck, why not now?

For those interested in really studying the insurance industry, I would suggest you start by reading every single letter by warren buffet from 1957 to 2018. It’s about 3,300 pages. When you’re done, you will wish it was 10,000 pages.

Berkshire is after all the biggest reinsurance company in the world, and GEICO is the second largest car insurance company in America. They are also the most profitable insurance companies in the world. Everything i know about insurance companies, i learned from those letters.

Let me warn you first, this will be long.

Insurance companies like banks, have many hidden complexities, and to think you can just roughly value it is a mistake. There is a reason why many funds refuse to buy shares of insurance companies.

So let’s start.

Overview on insurance industry

The insurance industry is a very unique kind of business. Like banks, it is a little similar, in that the business in one way or another, consist of creating money out of thin air.

In the case of an insurance business. It like this. The insurance company hands over a piece of paper to the customer. The customer signs the paper and gives them back the paper and a stack of money.

Needless to say, the nature of it, is therefore one of a highly competitive commodities business.

Now the money received, is in more ways than one, a loan. And the goal of an insurance business, is for the cost of the loan to not be higher than the average borrowing rate, or better yet, the risk free rate.

The best of the best insurance companies, actually make money on the borrowed money. ie, people pay to borrow them money.

This borrowed money, in the insurance industry is called “Insurance Float”.

For Malaysian companies, we can easily derive this by taking the net insurance liabilities. They’re various categories in the balance sheet (both asset and liability) side that relates to the insurance float, and you basically need to get the net figure.

And the profit or loss (usually loss) on this float, is seen in the “Combined Ratio”, which is essentially the profit or loss over the net premiums earned. A combined ratio of lower than 100, means the float is profitable, a combined ratio of more than 100 means the float is unprofitable.

Another tool people often use in valuing the insurance business, is identifying the “Cost of Float”. This is essentially the insurance loss or profit, over the insurance float. It is recognized as a %.

This float is then used to invest in financial assets, in order to earn a higher return than the cost of the borrowed money. This is how most insurance companies make their money.

Historically, almost every insurance company loses money in their insurance business and make it in the investment business.

A tool we use to try and identify the investing acumen of the insurance company, is “Investment Return on Float” which is the investment income divided by the insurance float.

And we thus reach our second part. There are two parts to an insurance business.

- The insurance business

- The investment business.

Let’s dig into them.

Investment Companies – Insurance divisions.

There are various types of insurance businesses with various products. But by and large they mainly differ in these key areas.

- Duration of contract and Counterparty risk

Depending on the product, travel insurance or reinsurance. The contract could have effects that last from either a few hours, or for a few decades.

Usually insurance like travel tend to have very short periods, vehicles, health, fire, life etc is usually one year.

While reinsurance contracts can sometimes last for decades. And the main risk here is counterparty risk. The longer the period, the higher the probability that the other party would not be able to pay up.

This is why we have things like T+3 in stock markets etc, because if it is T+120, the likelihood of the person being unable to pay becomes much higher.

Therefore, for things like reinsurance insurance, or catastrophe insurance. The thing most people look for is absolute financial strength. And this is the edge that Berkshire Hathaway has. The top 5 largest insurance premiums in the world were written by Berkshire.

Back in the day, people never really focused so much on the financial strength of the company, and tended to go for the lower offer. And since this is a business where someone signs a piece of paper and hands you over USD100million. Competition is naturally very cutthroat. With more and more people willing to take higher and higher risk.

And often, when these contracts turn out to be bad, and the Company is bleeding money. They are then forced into two choices.

One, Go bankrupt.

Two, Write more insurance contracts at ANY price, just so that more money can come in to cover the shortfall. Try guessing the road usually taken.

Needless to say, the new contracts are even worse, and it’s a matter of time before the bleeding is too much for new contracts to cover.

The insurance industry also has boom and bust cycles. So when one person is bleeding, the others usually are to.

And when everyone is doing the same thing, ie, writing insurance at any price to cover the increasing bleeding. You get catastrophic results when the music stops playing.

Which is why the insurance industry is in more ways than one much more regulated now.

- The size of average premiums

For things like travel insurance etc, they tend to be very small.For things like reinsurance, they tend to be huge, with one or two, reaching premiums in the billions of dollars.

This result very different kind of risk for each company. Most is elaborated in the point above.

- Predictability of the risks

For most of the products, the risk involved is very well known due to the sheer amount of data.

Car, health insurance, life insurance etc etc. All of these come with commonly available and well known actuarial tables.

The only edge most insurance companies of this kind can have, is an inherent business structure that cannot be beaten, economies of scale, better cost control, network effect and strong management.

What is strong management?

Any listed company will be subject to expectations of consistent growth in top line and bottom line. However, as the insurance industry is very cyclical like the stock markets. There are times, you must be willing to write nothing if the premium is wrong.

To allow your revenue and profit to drop by 50% or even 80%, because people are not paying you the right price for the risk being taken.

Many insurance bosses, know this, but needless to say, very few listed bosses dare to do this, other than Warren Buffet.

How about the rest? Network effect, Economies of Scale etc?

I would strongly suggest you read this answer by Glenn Luk. It’s a brief study on GEICO, Warren Buffet’s car insurance company.

However, for the reinsurance business, special insurance and catastrophe insurance, large data samples are often not available.

What is probability of a hurricane hitting texas, and how has global warming affected your odds?

When selling catastrophe insurance, did you price in terrorist attacks? Or bio attacks? Berkshire lost USD2.1 bil in 9/11.

How much is Micheal Jordan’s leg worth, and what kind of premium should we charge?

Very interesting question. And for these, you need extremely good management with a deep understanding of probabilities and risk.

Investment Companies – Investment divisions.

What about the investment portion of the business?

For many insurance companies, your ability to invest this float is make or break. If managed extremely well, you can turn USD17 a share to USD300,000 a share.

Berkshire Hathaway would not be where it is today, if Warren Buffet did not go into insurance companies and buy/develop so many of them.

He values the float so highly, that if someone offered him USD60 billion in cash (an asset), for the insurance float of USD 60billion (a liability in the balance sheet), he would say no.

Most insurance companies need to keep most of their float in low volatility and very safe investments, such as bonds, treasuries, government debt, fixed deposit etc. Not much return really.

One of the key advantage an insurance company can have here, is to have a strong parent company, with AAA rating, which would allow them to loan money at low rates, and also invest more freely into things like stocks, entire business etc

Unless it is a reinsurance company, chances are, if you’re talking about a standard issue insurance company etc, this is likely to be the division that has the highest risk, because your ability to know what the money is being invested in is very limited.

In 2008, a small subsidiary of AIG, called AIG Financial Products Corporation, basically sold insurance on Collateralized Debt Obligation (CDO) and Mortgage Backed Securities (MBO) at stupid prices, thinking they were really worth AAA.

The profit from this was considered free money, and was not that significant for the group.

In addition, the company also bought a lot of these MBO’s and CDO’s because they were considered to be as safe as AAA bonds and recognized as such in the financial statements.

AIG lost USD 99.2 billion in 2008, and was essentially sold and nationalized by the government via an issuance of warrants amounting to 80% of the company.

Companies like Allianz, Manulife etc lost money as well during the crisis, but not as much.

This is really the main risk of investing in insurance companies these days.

Conditions unique to Malaysian insurers.

Unlike our American counterparts, our Bank Negara here, actually take steps to regulate the pricing instead of allowing a full on competition to the bottom and further. Ie, the Tariff Structure.

General insurance, car insurance etc is priced based on a table given by Bank Negara. This means in Malaysia, it’s mainly a question of who has the better business structure, economy of scale and cost control instead of who can offer stupider pricing.

This is also why Malaysians pay a little bit more on average for car insurance. At least when you have not fully gotten your NCD. Our system rewards those who are safe drivers very well.

Having said that, since July 2017, BNM have been deregulating the car insurance, general insurance and life/family insurance. So things are looking interesting.

Also, life and health insurance have very low penetration in Malaysia with less than 50% of the population having coverage. So it’s to an extent a growth industry.

Valuation

If you’ve read this far waiting for a “Rule of thumb” to value insurance stocks. Unfortunately, I cannot give you any. There are too many factors. It’s a lot more qualitative than most.

You need to judge the “Combined Ratio”, “Insurance Float”, “Cost of Float” and “Investment Return on Investment Float” over a long period.

As well as various qualitative aspects, such as the business, the character of the management, its track record, the leverage and other things. All of which are far from easy.

And if you’re done with the above. The general rule of thumb, is somewhat similar to most companies.

ROE needs to be high enough to cover the cost of capital. And assuming it’s a fairly decent one, below 1X book is probably cheap, and above 2x book is probably a bit expensive.

However good things are sometimes worth paying for, as I’ll show below.

Table for most insurance companies in Malaysia.

Here is a valuation table i made for most insurance companies in Malaysia approximately a month ago. It should prove useful as an initial starting point in valuing insurance companies.

Do note pretty much every bank in Malaysia have insurance operations, but other than Maybank, I could not extract meaningful data from their annual reports. In the case of BIMB, their insurance arm, Takaful is listed.

The biggest insurer in Malaysia by far is Maybank Etiqa.

Here is a link for your reference, and drive whatever conclusions you may.

Why no pictures you ask? I have no idea why i cant post pictures into i3 for some reason. refer to the link above.

You may be wondering why certain insurance companies like MAA or E&O etc are not in? Its simple, the extraction takes a lot of time.

Some companies are obviously rubbish, some companies have insurance operations, but is already disposed and classified under discontinued operations or asset held for sale. and some i like quite a bit and so i’m not so keen on showing it.

On MNRB, i think its probably rubbish. I don’t see why any insurance company worth a damn, would ever need such an insane right issue, when dividend have not been paid for a couple years to begin with

My guess, they fucked up their loss reserves/contract liabilities estimation or something, and now need capital to cover up the hole.

The right issue is to recapitalize the retakaful and reinsurance business. This business is largely global, with competitors coming from overseas. I doubt MNRB is in any shape to compete with Berkshire Hathaway.

As said previously, management is key in insurance business, and MNRB does not look like it has a good one to me.

One may then say, but its so cheap at 20% of book!

Well, they are better companies selling for cheaper now. If your insurance book is rubbish, it will naturally be cheap.

Expenses wise, its roughly in line with other insurers.

But a major red flag for me, is they deferred RM320m payment of credit facility to Ambank. What kind of reinsurer are you, if this kind of payment also need to defer.

In reinsurance, you name and ability to pay is gold. For people to know, that you will be alive when everyone else dead to pay is one of the most important factor for a reinsurance company.

Why LPI and Tan Sri Teh Hong Piow is a god

From the table above, you may have, noticed a very significant outlier in LPI. Which has on average made a profit of 15% on its insurance float, and 28% investment gain on insurance float for the last year.

The reason why LPI excelled so much on the insurance front, was mainly because prices were fixed. And Tan Sri Teh Hong Piow, running LPI like how he runs PBBANK. Only writes insurance that is profitable, ie, from people who are likely to not cause much problems only.

He is willing to give up market share for profitability.

In addition, from conversations with LPI customers, one of the reason they buy LPI, is due to tie ups with PBBANK in certain areas, fast claims when anything happens, and its Tan Sri Teh Hong Piow. As long as its profitable, he can be flexible and understanding.

And like all companies Teh Hong Piow, cost is controlled by nobody business. Most banks and insurance companies undergo billion ringgit IT upgrades, and office refurbishment, new buildings (Affin’s new building is going to cost 13% of its Market Cap).

While PBBANK and LPI still uses pen and paper for some areas, extremely old furniture etc.

How great it is to an early PBBANK and LPI shareholder!

Just in case you’re wondering why LPI investment income is so high. Unlike most insurance companies, roughly 80% of the float is in equities, instead of Malaysian bond/treasuries or unit trust.

And most of the equity held is Public Bank Shares.

“The secret to investment is to find places that is safe and wise to be highly concentrated.” – Charlie Munger.

Teh Hong Piow clearly understands that.

Is LPI cheap? Well. It’s around fair value. I’ll leave it at that. I won’t say why, as the fun part is finding out on your own.

Conclusion

I hope this was as useful to you as writing this was for me. I definitely learnt something new when crystallizing my thoughts. A company I thought wasn’t that great turned out to be fantastic.

As always, do let me know you thoughts. Especially if you think I’m wrong, or you have very different perspectives from me.

Update

The Relationship Between Basel III (Banks), Solvency II (Insurance Companies) and Sovereign Debt.

Here is an interesting statistic, across the world, out of the 196 countries in the world, only around 50 or less countries run a budget surplus or balanced budget, ie the country’s revenue exceed/equal its expenses consistently.

The rest of the world runs on a deficit and needs to borrow money in order to cover the shortfall in government revenue.

And out of the 50 or less countries that balance their budgets or have surpluses, the significant economies (large enough) are,

- Macau

- Hong Kong

- Norway

- Singapore

- Jamaica

- South Korea

- Sweden

- Iceland

- Bulgaria

- New Zealand

- Germany

- Berlarus

- Luxembourg

- Netherlands

- Czechia

- Uzbekistan

- Switzerland

- Taiwan

Combined, these countries barely consist of 10% of global GDP. In addition, their total surpluses also does not exceed even 3% of the total deficits of the rest of the countries.

And thus the question, who are the ones borrowing money to these countries? Thus, enabling them spend far beyond their means, and allowing huge fixed costs to build up in economies around the world.

Well, allow me to introduce you to “Basel III” (New Regulation for Banks since 2009) and “Solvency II” (New Regulations for Insurance Companies since 2009).

Both of these two regulations were given rise via directives from the European Union after the 2008 Great Financial Crisis and subsequently adopted worldwide.

Banks (Basel III)

For banks, Under the new Basel III regulations, there is something called the Liquidity Coverage Ratio, which requires banks to maintain lots of very safe liquid assets like government bonds to cover funding stress.

This ratio also categorizes certain deposits as “non‐operating” and assigns them punitive haircuts when calculating the ratio.

These deposits include deposits received from the retail market. For example, fixed deposits or current accounts placed by individuals or companies.

In response to these regulations, banks are therefore incentivized to purchase and hoard sovereign debt sold by all these countries running fiscal deficits, while looking for loopholes enabling them to more profitably carry these non‐operating deposits.

These methods include:

- Asking customers to switch unwanted deposits into sovereign bonds the bank can hold in custody

- Asking customers to take out loans to buy sovereign bonds and replace the cash.

- Asking customers to transact through off‐balance sheet derivatives such as

swaps - Asking customers to replace physical cash positions with synthetic look‐alikes, collateralized with sovereign bonds.

All of which drives up the demand for sovereign bonds.

Insurance Companies (Solvency II)

The Insurance Companies are also under a similar situation when it comes to their Portfolio they hold and the Capital Charges/Haircuts required for each asset class in order to calculate Solvency Ratios.

Now, its probably not that easy to imagine the above scenarios, so lets put some numbers to it.

Illustrating Distortions cased by Basel III and Solvency II

Imagine a Bank/Insurance Company, lets call it “Baka-Surance Bank”.

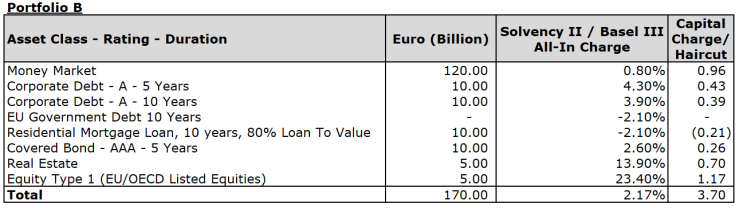

Now, for reference, here is a sample Capital Charge/Haircut table. For simplicity sake, we assume that the Capital Charge/Haircuts are the same for both the Bank and Insurance Company.

Now, a “Standalone Charge”, is the Charge for the asset class on its own, while the “All-In Charge” includes other factors such as diversification and duration matching which should theoretically bring down risk, which is why its slightly lower.

Now one thing you will find very interesting here, is that EU Government Debt, or Sovereign Debt actually have a negative All-In Charge, which gives rise to the distortion.

To illustrate, lets use the following example. For our example, we will be using the All-In Charge figures.

Now “Baka-Surance Bank” holds a portfolio as above, and when calculating Solvency or Liquidity, its asset amounted to (“Original Asset Value” Less “Capital Charge/Haircut”), (EUR170 Billion less EUR0.8 Billion) EUR 169.2 Billion.

Now, after reviewing their portfolio, it noted that all of its “EU Government Debt 10 Years” are negative yielding. By investing money into these bonds, they are basically guaranteeing that they will lose money.

As the sovereign debt trades to a negative yield, it would be wise to sell it in order to hold cash. Selling the debt would increase liquidity, raise the portfolio’s return, lower duration risk, reduce market risk, and even reduce credit risk, as government debt can default.

Baka-Surance Bank therefore decided to sell all of it and to the “Money Market” ie, they basically chose to hold cash instead.

After the portfolio readjustment, the Portfolio now looks like this.

However, if they did this, the Capital Charge/Haircut is now EUR 3.7 Billion, having increased from EUR 0.8 Billion

When calculating Solvency or Liquidity, Baka-Surance Bank’s asset amounted to (“Original Asset Value” Less “Capital Charge/Haircut”), (EUR170 Billion less EUR3.7 Billion) EUR 166.3 Billion, which is now lower than when it held negative yielding sovereign debt, EUR169.2 Billion.

From this, you can see how Basel III and Solvency II practically forces Bank and Insurance Companies to hold sovereign debt.

And so, we now have the question.

As governments around the world continue to borrow money to fund ever-escalating budget deficits, and Banks/Insurance Companies are constantly incentivized to keep purchasing these Sovereign Bonds.

Given the size of the persistent deficits of these nations and the size of their hidden liabilities (17 Nobel Laurates on USD200 Trillion Deficit), which over time will inevitably result in the inability of a nation to pay its debts, and require debt forgiveness.

Well, today governments around the world are bailing out the public.

Who will bail the bailors? Where can these Government go for bailouts when its their turn?

Is it possible for the debt being so huge that it becomes impossible to bail out the country then? What happens next?

Well, these are questions so big, that i have no idea how to answer it, however, it does matter when it comes to making a decision on whether to invest in a bank or Insurance Company.

2 thoughts on “The Art Of Valuing Insurance Companies and why Teh Hong Piow is a god (LPI)”