I wrote this piece on NAGA 1 month ago, but didn’t post it for my own reasons. In hindsight, this is a good thing for my readers, as you can now buy it for a slightly cheaper price. I wrote a brief update to the piece at the end subsequent to new information available. As the new information is favorable, my thesis have not changed.

Overview

If we were to go back to March 2020 and asked ourselves if the pandemic would be over by July 2021, chances are we would have agreed, using the SARS pandemic as a reference.

Instead, for the last 15 months, for most of the world, the pandemic has constantly alternated between “Under Control” and “Outbreak”, with the mood of the markets alternating between “Hope” and “Hopelessness”.

However, the fundamental facts of the matter are this. In March 2020, the future regarding COVID 19 was extremely opaque, with very little information regarding when a vaccine will be ready (or if its even possible to create one, as till today, there is no vaccine for SARS), how much time will be needed for testing and manufacturing etc.

Today, these facts are very clear.

There is not just 1 vaccine, but 4 types of vaccines, under 7 different pharmaceutical companies (and increasing). Currently, manufacturing facilities all around the world running 24/7, with around 5-6 billion doses manufactured in just 7 months, and new manufacturing sites being opened every day.

In addition, despite low interest rates, and a general underlying optimism in the stock market fueled by the mantra “Cash is trash”, due to the quantitative easing by central banks arounds the world, there are some key pockets of value, with a key one being casinos located in the developing world.

During this pandemic, due to development and manufacturing of vaccines being primarily located in the developed countries, this has resulted in,

- Vaccination levels in the US, China and parts of Europe being far higher than the rest of the world.

- US, China, and Europe having largely reopened while developing countries, especially those located in Asia, undergoing new lockdowns.

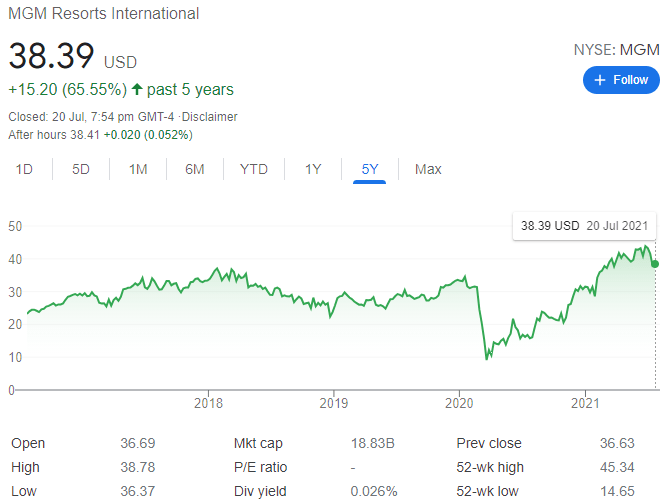

- Share prices of resorts and casinos in the US being less than 10% off their pre-pandemic highs. With casinos like MGM Resorts International being 15% higher than their pre pandemic prices.

- Meanwhile, facing renewed lockdowns, casinos in developing countries are selling at less than their 50% lows.

With what I consider to be one of the best casinos (if not the best) in the world, whether measured in terms of,

- Management Capability

- Economics of the Casino

- Shareholder mindset

Selling at 60% below its pre-pandemic prices, and at a mere 7X normalized earnings, even after accounting for the new tax laws.

So, who is NAGAcorp Ltd and why do I think so highly of them?

Understanding NAGACORP LTD (NAGA)

To understand NAGA, we need to look at it from 3 main perspectives. In order of importance, they are,

- The economics of NAGAworld

- The operational ability of the management

- The managements’ view towards minority shareholders.

The Economics of NAGACORP

Currently, NAGA operates a casino called Nagaworld, located in Phnom Penh, the capital city of Cambodia.

Their biggest moat is NAGA’s monopoly in operating a casino within a 200km radius of Phnom Penh, and their biggest risk, is therefore the ability to maintain and extend the monopoly period.

There is no other casino in the world that is given such favorable terms.

NAGA started their casino business the same year Cambodia started opening the country and developing the nation.

It was opened in the center of their capital city Phnom Penh, and over the years, it would not be an exaggeration to say that significant parts of the city have been built around it, with the casino being a landmark building today.

This is the equivalent of Genting Malaysia being built like KLCC, in the middle of Kuala Lumpur, back in 1985, with a 200km monopoly.

The economics of such a casino is completely different from one where you need to travel 3-5 hours and drive up a mountain. Or where you need to travel to a completely different state (Las Vegas), or island (Macau).

The closest equivalent is Marina Bay Sands (“MBS”) in Singapore. Except MBS is not a monopoly, it needs to compete with Resorts World Sentosa and is located at the edge of Singapore. Singapore is a small country but travelling to MBS still requires around 1 hour.

To understand deeply NAGA’s relationship with the government, and therefore their ability to maintain and extend the monopoly period, we need to study the history of the company.

In 1994, after going through the Khmer Rouge regime from 1975-1978 as well as occupation by the Vietnamese from 1978-1993 in retaliation for border raids by the Khmer Rouge, the Cambodian government was formed by both the King of Cambodia, and the current prime minister of Cambodia, Hun Sen.

That same year, to develop the country, the Cambodian government invited proposals as part of an international tender process for the development of a casino resort in Cambodia.

Tan Sri Dr Chen Lip Keong (“TSCLK”) the founder of NAGA, was the preferred bidder in the tender, and in 1995, he signed an agreement with the government for the exclusive right to operate a casino in Phnom Penh for 20 years, till 2014.

That same year, this extremely efficient and pragmatic man, TSCLK, immediately commenced gaming operations of a barge anchored on the bank of the Bassac River which is in the central area of Phnom Penh.

From 1995-1999, several unlicensed casinos opened which affected TSCLK’s business, at which point, in the year 2000, the Cambodian government themselves, immediately took action to shut down all casinos in Phnom Penh except for the one operated by TSCLK.

That same year, the Cambodian government affirmed the 70-year duration of TSCLK’s Casino license, as well as his 20-year exclusive rights for an initial 20-year period to conduct casino gaming within a 200km radius of Phnom Penh.

In 2005, the government of Cambodia extended the exclusive right to conduct casino gaming within a 200km radius of Phnom Penh by a further 20 years, to 2035, in exchange for TSCKL’s right to develop the O’Chhoue Teal area, the NAGA Island resort, the Sihanoukville International Airport and other related facilities which was valued at USD155 million.

During their 2006 IPO, these rights were transferred into NAGA.

In 2019, NAGA entered into agreement with the Cambodia Government to extend the exclusive right to conduct casino gaming within a 200km radius of Phnom Penh by a further 10 years to 2045, for a USD10 million payment in 2019, and USD3 million payment yearly from 2036 to 2045.

An utterly incredible bargain.

From the above, we can see that on balance, it appears that NAGA/TSCLK have quite a good working relationship.

The government does disagree with NAGA on certain matters, such as the development of a non-casino resort in Angkor Wat, called “Angkor Lake of Wonder”, due to fears that the development could impact Angkor Wat’s status as a World Heritage listed site. This is a minor issue for NAGACorp, but a big deal for the Cambodia Government.

But when it comes to matters that are very important to NAGA such as the shutting down of casinos within their 200km radius monopoly, or the extension of monopoly in 2019, the government have largely worked together with NAGA for mutually beneficial solutions, that often tilts in NAGA’s favor.

NAGA also returns the favor by helping the government with the tax laws concerning gambling and being flexible in making ad-hoc tax payments (due to gambling tax laws not being formulated yet) after discussion with the governments. I will elaborate about this later.

All in all, from my observation, it appears that NAGA and TSCKL is much more adept than Aéroport international de Phnom Penh (a Muhibbah associate, who lost their airport monopoly and is currently in arbitration) at building relationships with the Cambodian government.

Unlike the French, TSCKL is willing to take the actions necessary to maintain the relationship.

Just recently, after a private donation by TSCKL into Cambodia’s COVID-19 Vaccine fund, Prime Minister Hun Sen wrote the following in a letter,

I think his monopoly is safe for the next few years.

The operational ability of the management

When running a casino, there are a few main items that management need to get right operationally,

- Win rates consistency (Quality of Game Protection teams)

- Doubtful Debt Levels

- Working Capital Management

Win rates consistency (Quality of Game Protection teams)

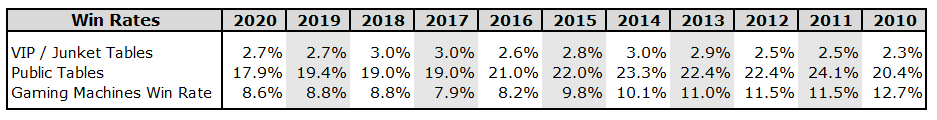

Since the start of the casino, the company have been able to maintain consistent win rates (it fell compared to 2016 – 2015, due to change in preferred game mix for Slots and Public Tables. Different games have different win rates).

And unlike many other casinos who have suffered from “Advantage Play”, where people try to find an edge over the casino (Genting owned Crockfords famously lost USD 10 million to Phil Ivey in Baccarat), NAGA have been able to reduce these by doing something quite interesting.

For the junkets who bring in the high rollers, instead of paying them a commission based on Game Rolling Volume, they split the Net Profit/Loss with the Junkets on a percentage basis.

IE, only if we make a net profit (including entertainment costs) do you get any money. In addition, they only deal with large Junkets who are required to be co-owners of the VIP Rooms. And to be a co-owner, these junkets need to put down a very sizable deposit, from which any penalties or losses from the VIP players are deducted.

When they first implemented this policy, VIP Rooms which has historically been a marginal money maker (sometimes profit/sometimes loss), became very consistently profitable. From 2016, with the opening of NAGA 2, they were able to triple VIP volumes with very little loss or doubtful debts, unlike Genting Singapore.

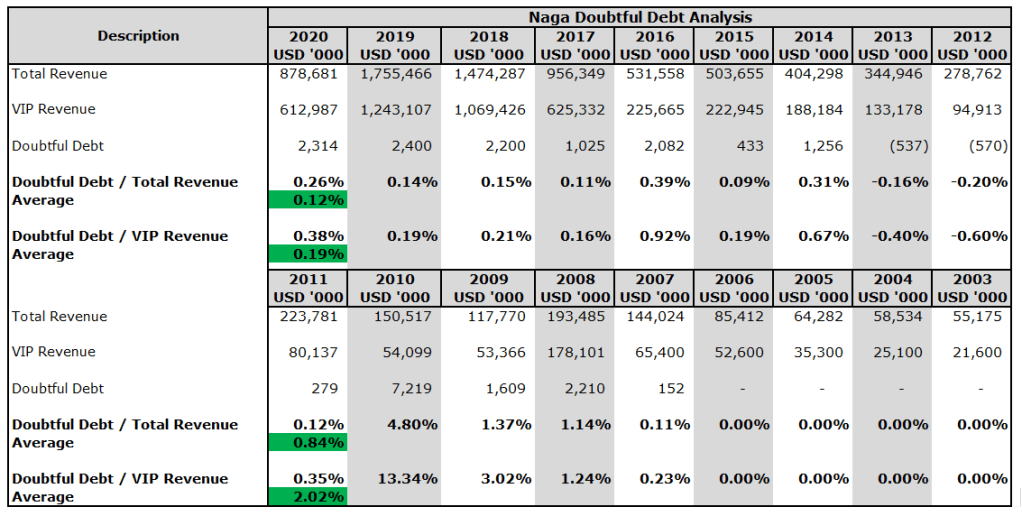

Doubtful Debt Levels

Doing a detailed look at NAGA’s doubtful debt levels (which is wholly related to VIP customers), when they first started out from 2007-2010, doubtful debt levels slowly increased before reaching a peak in 2010 with the financial crisis ongoing.

In 2010, to counter the bad debit issue, the management instantly implemented a few strategies,

- Consolidation of junkets to only a few major junkets. Smaller junkets who want to work with NAGA, need to go through the major junkets.

- Credit terms are only given to the large junkets, and they are shortened to just a few days, or 1-2 weeks after the trip at most. (Junkets usually get their own kind of chips). Cash only terms otherwise.

- Profit & Loss sharing, versus commission based.

As a result, Doubtful Debt as a % of Total Revenue & VIP Revenue for 2012 – 2020 fell to 0.12% & 0.19%, from 0.84% & 2.02% in 2003 – 2011.

How does Genting Singapore compare?

Well, when Genting Singapore’s Resort World Sentosa first started, they really targeted the high rollers, and gave very significant credit lines to compete versus Marina Bay Sands.

Doubtful Debt as a % of Gaming Revenue for Genting Singapore rose from 4.5% (already double that of NAGA’s peak), to 15.5% of Gaming Revenue in 2015. Utterly insane.

Only in 2017 as significant steps taken to reduce doubtful debt, however, by 2019, it has again doubled from 3.04% in 2017 to 6.24%

At their best, Genting’s Doubtful Debt as a % of Gaming Revenue is still 15X higher than NAGA’s. And at their worst, it is more than 100X higher.

Why is this the case?

Well, other than the fact that Genting Singapore is just not as effective as NAGA is at employing a wide array of methods to collect debt (read between the lines), the fact that there is zero competition in Cambodia meant that NAGA could dictate the terms in a way that result in the best outcome for them. The power of a monopoly.

Working Capital Management

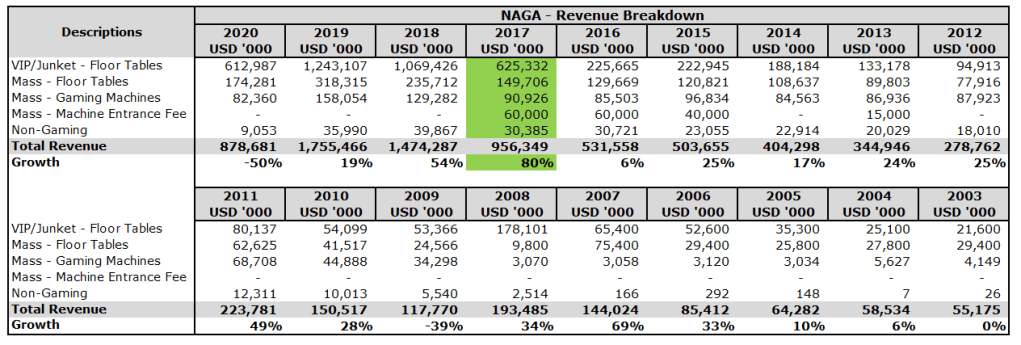

From 2006 (NAGA IPO) to 2019 (NAGA’s Peak Pre-Pandemic), NAGA’s Revenue has increased by more than 21 times from USD85.4m to USD1.76bil.

During this period, they have increased capacity in NAGA 1, and opened NAGA 2, which effective doubled their capacity and tripled earnings.

All these should have resulted in higher Working Capital Requirements.

Except, Working Capital requirements went from positive USD8.4 mil to negative working capital (ie business is funded with supplier money) of USD79.8 mil.

Not much else needs to be said.

Summary on Financials

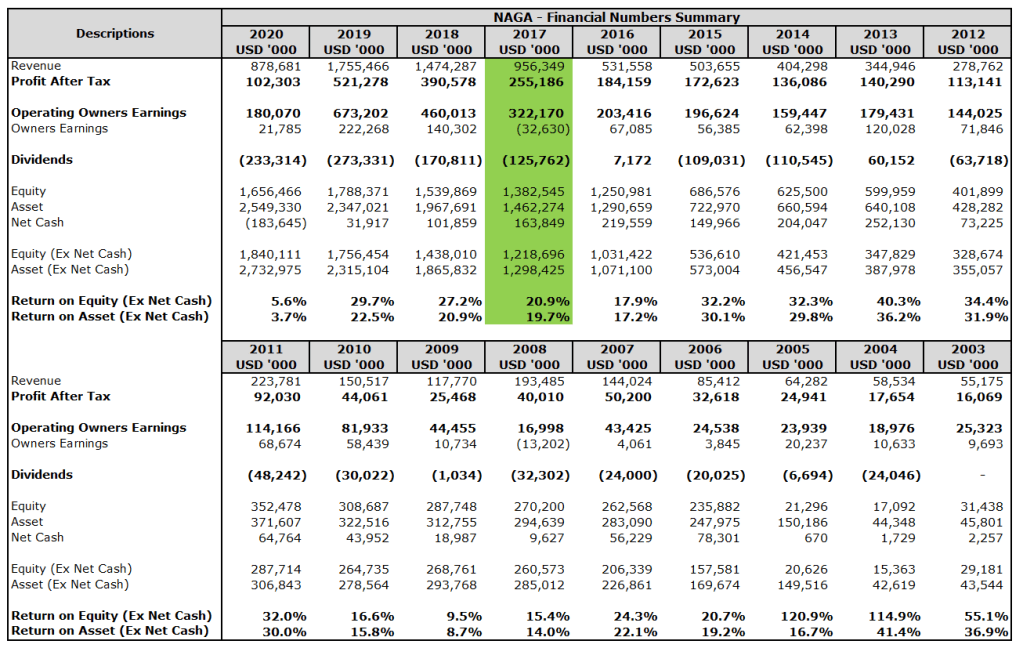

So, what happens when the best casino monopoly in the world meets great management? How does the numbers look like? Well,

*In 2017, NAGA 2 was opened, resulting in Revenue’s doubling that year, and more than triple 2016 revenue by 2019.

Double digits growths very consistently, revenue tripling in 3 years when NAGA 2 opened, and a 2003 – 2019 CAGR of 28%.

This is one of those situations where I don’t think there a need to elaborate much, as the numbers are fantastic and speak for themselves.

In terms of Return on Asset, NAGA is easily number 1 among all casino’s listed in the world.

And if compared based on unlevered Return on Equity, since NAGA is currently running on zero debt basis, unlike Wynn Macau for example which is leveraged to the teeth, NAGA is also number 1.

One thing to note, in 2017, the company’s revenue and earnings jumped significantly due to the opening of NAGA2.

Managements’ Action towards minority shareholders

One misconception that some people have, is that TSCKL is unfair towards minorities in NAGACORP.

This is no surprise due to how Karambunai Corp Berhad and FACB Industries Incorporated Berhad, his Malaysian listed companies are run, as well as some very interesting financing structures employed by TSCKL and NAGAcorp.

To determine whether managements actions are fair towards minority shareholders, we will need to study 3 main items.

- Unique Financing Structure Between TSCLK and NAGA

- TSCLK Renumeration Package

- Director Renumeration

Unique Financing Structure Between TSCLK and NAGA

2011: TSCKL to build NAGA 2 for USD369m, Payable via Shares to be issued at HKD1.8

In 2011, TSCKL entered a deal with NAGA, where TSCKL will build NAGA 2, which consist of NAGACity Walk, an underground retail center with China Duty Free as an anchor tenant, and TSCLK Complex, which will essentially double NAGA’s hotel and casino capacity and provide many other amenities like nightclubs etc.

The total project was expected to cost around USD369m and was completed by 2016.

In exchange for NAGA 2, the USD369 million construction cost is to be paid via NAGA shares issued at HKD 1.8. This issue price was a slight premium to the market price then.

Initially, 1.57 billion shares were expected to be issued. However, in 2017, when the project was completed, 1.88 billion shares was issued instead.

This is because conversion price is linked to the initial 2011 share base. If there were any corporate actions that resulted in an increased/decreased share base, the conversion price is to be adjusted proportionally upwards/downwards.

And so, the billion-dollar question. Was this structure necessary?

Historically, NAGA have run a very clean and efficient balance sheet, with most of the excess cashflow paid out as dividends.

When they made the plans to build and expand via NAGA 2, which was expected to cost USD 369mil, or around 10X previous year earnings then, they only had 2 options.

- Private Placement. Which is basically what this deal is, just a very smartly structured one done by TSCLK which increases his IRR significantly.

- Right issue

Why not debt?

Debt is not really an option. Even today, when borrowing just a relatively small amount of money, they are already charged 7-9% interest on a USD bond (currently it trades at 5% on the bond markets).

If they had decided to borrow money back in 2011, chances are the interest rates charged will be closer to 15%, at minimum.

Therefore, my guess is that TSCLK decided to fund this expansion using margin loans with his listed NAGA shares as collateral. The loan was likely drawn down as the construction take place.

Interest on HKD Margin Loans in 2011, backed by listed HKEX shares is likely around the 7-8% region, far lower than the 15% NAGA would have obtained from the banks or the bond markets.

Over the years, as construction took place, my guess is that TSCLK made sure NAGA has very high dividend payouts, to pay down the margin debt taken to fund the NAGA 2 construction on this end.

The question important question here then is this, is this fair to the minority shareholders?

Honestly, I think it is (mostly).

If this structure was not used, then what needed to happen to build NAGA 2, was basically zero dividend payout and a right issue, which lowers your returns the same way this direct deal with TSCLK does.

Except, in this case, you don’t need to come out with the money for the right issue, and you still receive dividends while the construction was going on.

And lastly, when this deal was structured with a conversion price of HKD1.8 in 2011 (which was at slight premium to the market price then), investors had their own chance to participate in this expansion plan indirectly, by buying up more NAGA shares in the open market to make up for the dilution. There was basically zero movement in the share price of NAGA 6 months after the announcement of the deal.

If one had thought TSCLK a good deal then, and that the shares were gold, you could have basically bought the shares in the open market at the same time and reinvested all dividends into new NAGA shares and obtain 80% of the same outcome as TSCKL.

It was slightly disadvantageous to minority shareholders, in that, the conversion price was linked to the initial 2011 share base.

And therefore, in the event of any right issue, which there was (and taken up by TSCKL), the higher share base meant that he got more shares, 1.88bil vs the initial 1.57bil.

In essence, the deal can be thought to a long-term variable call option, linked to the share base. Something an investor, or in this case, TSCKL, would only do, if he thinks that the shares at this price is a deal of a lifetime, and he would like to own as much of it as possible.

However, as a call option, it obviously cuts both ways.If the value of the share’s drops, it is very detrimental to him and very beneficial to the minority shareholders.

In any event, when NAGA 2 was opened, earnings and revenue increased by 300%, while the share base expanded by 76%. The share price also increased from HKD 1.8 in 2011 to HKD 12 in 2019. A very good outcome for both minority and especially for TSCKL.

Having said that, one downside faced by the minorities, is that unlike TSCLK who can essentially reinvest dividends at USD1.8, minority shareholders cannot do so, unless they margined up more than TSCLK initially.

2019: TSCKL to build NAGA 3 for USD3.5b, Payable via Shares to be issued at HKD12

A second deal was done in 2019 between TSCKL and NAGA for the construction of NAGA 3. NAGA 3 was expected to cost USD 3.5b and completed by 2025.

In this case NAGA is expected to fund half of the construction directly, with the other half being funded by TSCKL.

Like the first 2011 deal, TSCKL is to be paid in shares at a conversion price of HKD 12, it is also linked to the 2019 share base, and for this deal, unlike NAGA 2 where the share is only issued upon completion, the shares to be paid for NAGA 3 is to be issued upon various points of progress. However, this second deal is far fairer to the minority shareholder, in fact, it may even be slightly advantageous. For two reasons.

- The share conversion price is HKD 12, this was a 30% premium to the last closing price of HKD9.31 then. And this was a far higher premium than what was given in 2011.

- Half of the project is funded by TSCLK, and the other half by NAGA. However, all cost overruns is to borne by TSCLK, and all cost savings to accrue to NAGA.

In addition, given the opportunity to buy NAGA shares at today’s price of HKD6, this deal is very detrimental for him relative to the minority shareholders.

TSCLK Renumeration Package

One thing I do have to note, is that TSCLK’s renumeration package is not cheap.

However, it is fair, given that he is clearly the key man when it comes to not just running the casino, but ensuring the monopoly is maintained and extended, which he has done in 2019, when the monopoly is extended for 10 years for a very cheap price.

In general, I prefer owners like Warren Buffett of Berkshire Hathaway, or Goh Nan Kioh of Megafirst Corporation Berhad, who are not just fair, but outright doing charity for their shareholders. However, that is just too high a bar.

Unlike these two, TSCLK is not shy about making sure he is paid his due.

TSCLK in addition to his usual USD750k salary, he is also paid a performance bonus which is calculated using the following formula.

X < $30 million PBT: $ Nil performance incentive

$30 million < X > $40 million PBT: Performance incentive of 2% of PBT

$40 million < X > $50 million PBT: Performance incentive of $0.8 million plus 3%of additional portion of PBT from $40,000,001to $50,000,000

X > $50 million PBT: performance incentive of $1.1 million plus 5% of additional portion of PBT from $50,000,001 onwards

Over the years, he has been paid/entitled the following.

2010 – 2014: USD18.6 million (Forgone by TSCLK)

2015: USD8.1 million (Recognized and Paid in 2017)

2016: USD9.0 million (Recognized and Paid in 2017)

2017: USD11.8m (Recognized and Paid in 2019)

2018: USD18.6m (Recognized and Paid in 2019)

2019: USD26.2m (Recognized and Paid in 2020)

2020: USD5.2m (Not yet recognized or paid)

Yes, it is not cheap, but it’s not unfair (being a cheapskate, I’m hesitant about calling a salary amounting to tens of millions of USD fair, but it really is not unfair).

Director Renumeration

Throughout its entire history, NAGA always had a ESOS program but it was never used until 2021, when grants of shares totaling 18.6m to be issued over 6 years for the directors was announced.

Over the years, director renumeration (excluding TSCLK’s performance incentive), has remained relatively even.

Given the 2019 NAGA 3 deal that they have negotiated which is definitely very beneficial to minority shareholders, I don’t think this is excessive.

Reason for Listing

Having studied NAGA in detail since its IPO, I’ve often wondered why TSCLK wanted to list NAGA.

When NAGA was listed, they raised just USD69m, and paid out at the same time, a USD50m dividend and capital distribution. If he wanted to, he could have just kept the whole thing private.

Looking at this shareholder base during IPO, my guess is that he wanted to give his investors a way to cash out. In addition, he probably also wanted to tap personal margin loans/interesting financing structures like NAGA 2 & 3 deals for expansion at far lower interest rates.

I don’t think it’s possible for NAGA to have expanded as quickly and as cheaply it did without being publicly listed.

And looking at the language of the management (the word monopoly pops up at least 20 times each interim and annual report) it’s very clear that TSCLK wants a premium valuation.

And he is going to need that premium valuation to fund the NAGA 3.

Key Risks and Catalyst

The stability of Cambodia & Hun Sen

One main concern that people have is the stability of Cambodia as a country, and political risk as Hun Sen is essentially a dictator.

This concern is so prevalent, that NAGA includes a political risk analysis and comparative report in the annual reports.

When I was wondering if Cambodia is stable, it suddenly struck me that I should also be considering if the country I live in, Malaysia, is all that stable to begin with.

Unlike Malaysia, Cambodia has no major religious strife, no major ethnic tension, no political tension, and 7% yearly GDP growth from 2011 – 2019.

Dictators can only stay in place when the needs of the people are met, or, when they have created a system where the power for potential violence is so strong for the dictator (and that dictator is not shy about using said powers), that it is close to hopeless for any internal uprising to happen, Ie North Korea.

Personally, having studied history, I fail to find any dictators who was kicked out by the public when the country is doing very well economically, ie 7% per annum average GDP Growth, this is the 6th highest in the world.

And it’s pretty clear based on elections results (it is obvious that it’s not a fair election) but looking at the number of invalid votes which is only around 15%, I’ll taking the odds that Hun Sen will be around for a long time.

Cambodia 2020 Gambling Tax Legislation

Since the start of the casino, NAGA have never paid “Income Tax” of the traditional sense.

This was due to Cambodia having not yet promulgated a Casino Law to determine the official casino taxes or license fees.

Instead, NAGA pays something called an “Obligation Payment”, which consist of a certain monthly amount that increases each year by 15%, and every other year, a negotiated amount with the government.

By paying this “Obligation Payment”, NAGA will no longer be liable for any kind of tax for that particular year.

However, in December 2020, Cambodia passed a new legislation called “Law on the Management of Integrated Resorts and Commercial Gambling”.

This new statute, sees tax levied at Gross Gaming Revenue (“GGR”) at 4 percent on VIP GGR; and 7 percent on mass-market GGR.

*2020 income tax is particularly high as the low revenue reduced operational leverage. For the sake of our comparison, we will discount it.

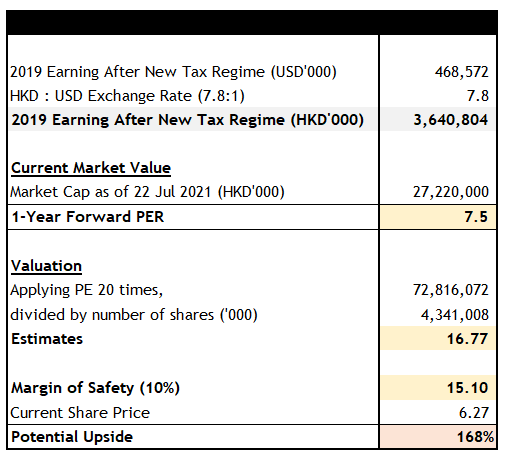

The application of this new tax law basically triples NAGA’s average income tax liability since inception from 5% per year on average, to 15% per year on average.

Being the only integrated resort in Cambodia, as well as due to their close relations with the government, NAGA worked together with the government on this tax law.

Personally, I’m quite happy with this tax rate.

It is higher than the original concessionaire rate of 9% that was given to Ariston to motivate investment into the country (NAGA’s predecessor), and lower than the 20% Cambodian Corporation.

The outcome seems quite fair.

Having said that, even after applying this new tax rate, NAGA is still

only selling at 7X 2019 earnings.

Cambodia March 2021 Lockdowns and Cashflows

In March 2021, Cambodia went through another lockdown due to the rising number of COVID-19 Cases, and NAGA voluntarily chose to close the casino temporarily.

Since then, like Malaysia, the number of cases has escalated.

This culminated in the borders with Thailand and Vietnam being closed at the end of June.

This resulted in the share prices of NAGA dropping to a low of HKD 5.85, which is far lower than its March 2020 low of HKD8.00

Is market pricing in these events rightly, or is Mr Market being a little too fearful?

To find out, lets look at it from two perspectives,

- NAGA’s future cashflows

- The Restart of Tourism and Vaccination Progress in Cambodia and ASEAN.

NAGA’s future cashflows

In terms of cashflows, as of December 2020, NAGA had USD452 million in cash and cash equivalents. They had USD300 million worth of Senior Notes that was payable on 21 May 2021.

Giving them remaining cash balances of USD152 million.

Since then, they have also raised another USD200 million at 7.95% maturing in 2024. (The order book demand was USD580 million). Giving them a total estimated cash balance of USD352 million as of today.

According to management, after the staff layoff of 1,300 staff in April 2021, and paycuts, monthly operating cost have reduced from USD8.6m to USD6.6m per month.

Including interest costs of USD2.3m per month, the monthly cost of surviving for NAGA is USD8.9m.

At the current cash level, NAGA could easily go on for another 20-30 months, though we obviously don’t want this to happen.

The Restart of Tourism and Vaccination Progress in Cambodia and ASEAN.

As an integrated resort in a tourism focused country, and with VIP’s being 70% of revenue and 30% of gross profit, with oversea tourist consisting of around half of this portion, NAGA is obviously is very reliant on how the vaccination drive goes on.

They stayed profitable in 2020, when allowed to open, but to hit the previous 2019 numbers, the borders need to reopen and travelling resume.

Currently, as of 20 July 38% of Cambodians have at least their first shot, and 26% is fully vaccinated. At the current pace, around 1.2% of the population is given a shot every single day.

In ASEAN, they are the second highest after Singapore in ASEAN, I think by early August they will hit the magical 50%, where countries can start considering loosening lockdowns and reopening borders.

One thing to note is that Cambodia primarily uses Sinovac, which is observed to be slightly less effective, so perhaps a higher vaccination rate is required.

As for the rest of ASEAN, based on the news, the rest of the ASEAN (which is the key customer base for NAGA) will be 50% vaccinated by December 2020.

If I was a betting man, my guess is that NAGA should be allowed to operate again come October at the latest, with the Cambodian borders reopening by December or January 2022.

I conservatively expect earnings to fully recover by late 2022 or early 2023.

For me, the most important question is whether people will still travel the same way they did pre-pandemic, and if people will still choose to visit Cambodia.

The problem is, it’s very difficult for me to think of a reason why people will not want to go travelling if the pandemic is handled, or to not visit Cambodia. The country is still safe, the tourist attractions will reopen, prices are cheap etc etc.

The Delta variant is an issue, but I think it will only delay things by 2-3 months even if a 3rd booster shot requirement for travelling by China is implemented.

NAGA Russia Casino

In 2014, NAGA had plans to open a casino in Primorye, Vladivastok Russia. This is a USD300 million project.

They broke ground in 2016, and the project was initially expected to commence operation in 2019.

It was initially deferred to 2020, before the pandemic hit, and today they are facing construction delays due to difficult for their Chinese contractors to enter Russia. The latest expected commencement date is 2022.

However, one thing to note is that the Primorye Government is very helpful towards the Casino’s as they are extremely serious about making Primorye a tourist destination with foreign investments.

Currently, they are helping NAGA get the workers in, and they are also allowing very low tax rates for Casino’s in order to develop the area.

Unlike the Cambodia Casino, this is not a monopoly. The Primorye Government intends to bring in a few other Casino’s to develop the area further.

So how will a casino in Primorye perform? There are two other Casino’s in the area current, Shambala Hotel (owned by a Russian Businessman) and Tigre De Cristal Hotel and Resort (which they offered to sell to NAGA, but NAGA preferred building their own), which is owned by Summit Ascent a HK listed company.

The area is still quite raw, and chances are quite a lot of development is needed, before substantial returns are available.

However, referring to Summit Ascent’s numbers, they are currently doing about 5% Return on Assets. Excluding depreciation, it should probably be around 11-12% Return on Assets.

NAGA’s initial estimate when they got the project in 2013, was IRR’s in excess of 25%.

It’s hard to say if those numbers can be achieved, though I think their returns should be better than Summit Ascent as the building plans looks significantly more attractive.

However, for now, I’m just going to assume that it’s not going to lose money.

In addition, I don’t think the entry of new casinos are necessarily a zero-sum game. Additional development should bring in more tourist.

Let’s see.

Tourism and Gambling in Cambodia

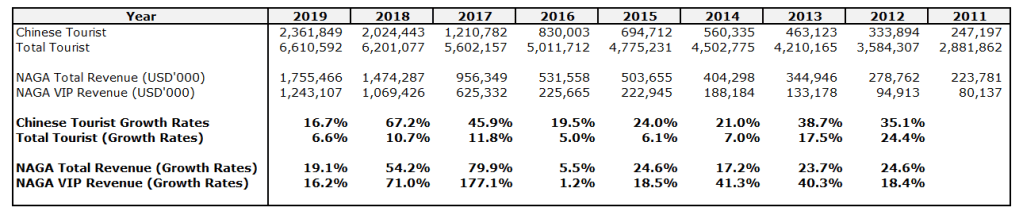

Pre-pandemic, tourism is an extremely fast-growing industry in Cambodia. For the last few years, much of the growths have come from the larger number of Chinese visiting Cambodia.

The question is how much that is NAGA capturing?

Comparing NAGA’s Revenue Growth (as a Whole or VIP Only, since VIP’s are primarily tourist), versus Cambodia’s Tourism Growth Rates (whether as a Whole, or Chinese Only), it’s very clear that NAGA is growing revenue far above the Tourism growth rates.

From the numbers, it does look like NAGA on its on is a Tourist Landmark.

One main concern is that on August 2020, China’s Ministry of Culture and Tourism has established a “blacklist” of overseas tourist destinations it says are disrupting the nation’s outbound tourism market by opening casinos targeting mainland Chinese customers.

I have no idea if NAGA is on that list, however, I think that NAGA is not likely to be too affected as,

- It is a tourist attraction on its own.

- A significant amount of VIP volume come from locals who do not have a Cambodian Passport, as well as Expatriates.

Back then during the Khmer Rouge period and the subsequent Vietnam occupation, many Cambodians fled overseas and become citizens there.

When the new government was made with Hun Sen and the King of Cambodia as the head, many of these people started coming back to Cambodia to start a business etc.

It is estimated that these individuals make up about 10% of Cambodia’s population, they stay primarily in the Capital City, and on average have significantly higher net worth.

In addition, Cambodia is also home to a lot of Chinese Expatriates. The existence of these two communities should ensure the earning power of NAGA.

Lastly, China and Cambodia have a very good relationship.

Given NAGA’s status and location, even if NAGA was under consideration, I don’t think it is possible to ban them, as to blacklist Chinese tourist from travelling to play at NAGA is equivalent to putting the entire city of Phnom Penh on the blacklist.

That is like the Chinese government putting Singapore on the travel blacklist due to Marina Bay Sands and Resort World Sentosa. I think this blacklist will only be enforced at certain cities where Chinese people go there ONLY for gambling.

Conclusion

At today’s price of HKD 6.27, NAGA is trading at something like 7 times 2019 earnings, after accounting for the new tax regime.

These earnings do not even account for,

- The fact that pre-pandemic revenue and earnings were still growing 30% year on year in 2020.

This means NAGA 2 full potential is not yet seen and let’s not forget the Naga 3 expansion.

I think the chance to buy NAGA at today’s price is like being able to buy Genting Malaysia at 1985 IPO, with Lim Goh Tong still at the helm, with the casino being located at KLCC.

One Last Thing

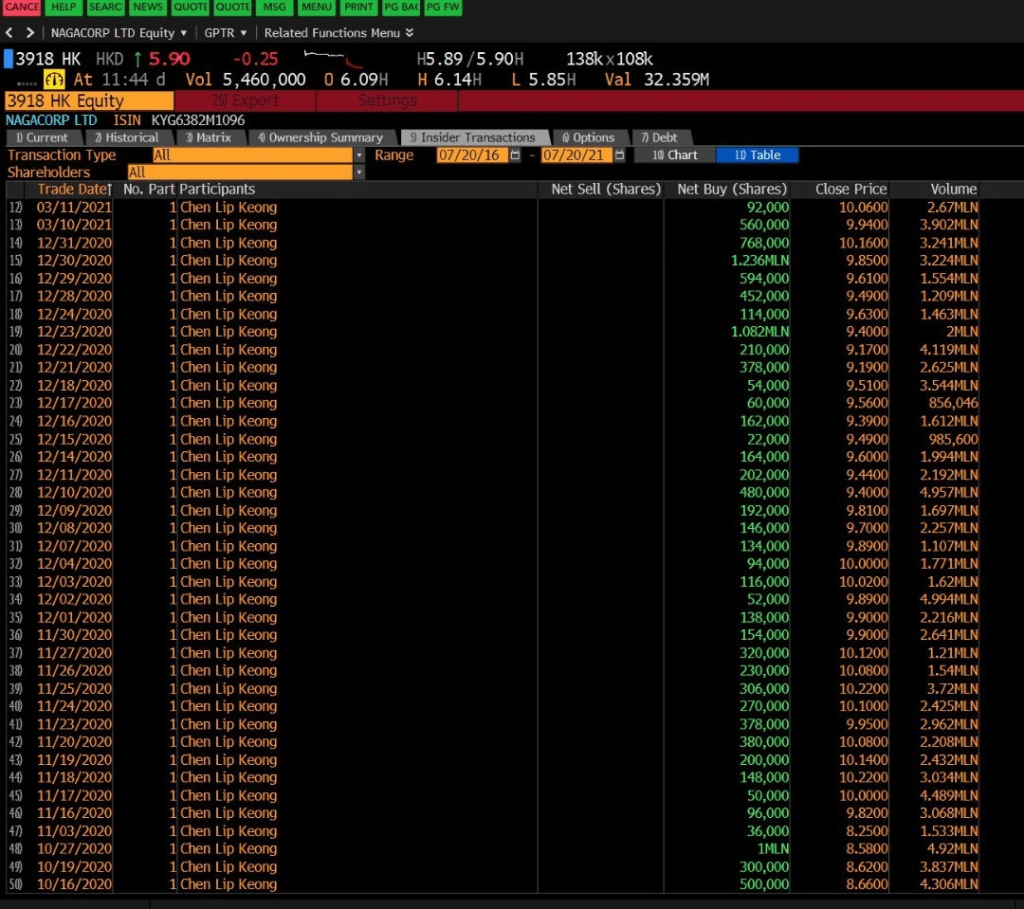

Tan Sri Chen Lip Keong bought many shares in 2020.

Recently he has slowed down from his buying as I have a feeling, he needed the money for the NAGA 3 expansion etc.

In terms of possible margin calls from him, I think it’s close to impossible, as he owns 75% of the company with his cost per share around USD1.5

Personally, I’m backing up the truck.

September 2021 Update

On 30 August 2021, NAGACORP announced their 1H 2021 results. They made a 1H 2021 loss of USD77 million, but recorded positive EBITDA of USD11m.

Personally for me, this was a very good result, as they only opened for 2 out of the 6 months (and only for locals), for operating cashflows to be positive is amazing.

During the first quarter, they incurred USD241m in capital expenditures, of which USD60m was actual cash outflow, the rest was basically paid for by TSCKL as per the 2019 Deal where TSCKL is to build NAGA 3 for USD3.5b, Payable via Shares to be issued at HKD12.

This explains why TSCKL stopped buying shares in 2021, i would too if i need to cough up USD180m in the middle of a pandemic.

Excluding the dividend that was paid in July 2021, the company has cash balances of USD190m. Expected cash capex for the rest of the year is around USD60m, so cashflows should be sufficient to ride through for another year of lockdown.

However, things are not so dire, according to TSCKL, NAGA have been in conversation with the Ministry of Health, and they expect to announce an opening date soon, as case numbers in Cambodia have been falling very significantly, and 99% of adults in Phnom Penh is vaccinated.

When reopening, NAGA also plans to have very strict Health SOP measures to prevent closings from happening again, such as

- Customers and staff must be fully vaccinated.

- Weekly testing for frontline employees

- The NAGA property will be split into 35 zones, each of those zones would require a QR code scan to enter. This would ensure that if there is another outbreak, only specific zones will need to closed for disinfection, instead of a full lockdown.

The above measures obviously cost a bit of money, but this is far far far lower than the cost of closing/not reopening.

Lastly, NAGA 3 is still on track in terms of the piling, obviously management will be observing demand during reopening and when borders reopen to gauge demand and see if the expansion still makes sense.

In general, NAGA thinks the expansion is a very good thing, but will still observe.

Very good note, thank you. May I ask where you saw TSCKL’s comments regarding the expected reopening dates and MOH SOP? Thanks.

LikeLike

I was in the analyst meeting.

LikeLike

Very good note, thank you. May I ask where you saw TSCKL’s comments regarding the expected reopening dates and MOH SOP? Thanks.

LikeLike

Great write-up. They have a mkt cap of around $4bn (after recent rally), spending $3.5bn on Naga 3. What do you expect the ROIC to be on that and how much are expanding slots, tables and VIP capacity by? And is there demand for all that? Do you expect the demand to mainly come from Tourism?

LikeLike